Flat depreciation calculator

Car depreciation refers to the rate at which your car loses its value from the first year you bought it. Number of years after construction Total useful age of the building 2060 13.

Annual Depreciation Of A New Car Find The Future Value Youtube

It takes the straight line declining balance or sum of the year digits method.

. Calculating Depreciation Using the Units of Production Method. This depreciation calculator will determine the actual cash value of your Curling Flat Iron using a replacement value and a 10-year lifespan which equates to 01 annual depreciation. If you are using the double declining balance method just select declining balance and set the depreciation factor to be 2.

Depreciation Amount Asset Value x Annual Percentage Balance. The depreciated value of the property is 1060 ie. There are many variables which can affect an items life expectancy that should be taken.

Real Estate Property Depreciation Calculator Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation. Asset cost - salvage valueestimated units over assets life x actual units made. Divide step 2 by step 3.

Depreciation Rate Basic Rate x 1 Adjusting Rate Bonus Rate Annual Depreciation Amount Depreciation Rate x Depreciation Calculation Basis x Fraction of Year Held For reporting. Deduct this depreciation from the construction cost of the property and add the appreciated land value to compute the. Depreciation Calculator Depreciation Calculator The calculator should be used as a general guide only.

Depreciation asset cost salvage value useful life of asset 2. Flat rate depreciation calculator. Flat rate depreciation calculator Related Articles.

This depreciation calculator will determine the actual cash value of your Flat. From RM 269k 52 seating. It provides a couple different methods of depreciation.

80000 5 years 16000 annual depreciation amount Therefore Company A would depreciate the machine at the amount of 16000. Depreciation Calculator The following calculator is for depreciation calculation in accounting. Double Declining Balance Method.

Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. Calculate Annual Depreciation Calculated and table. Flat-rate depreciation methods determine the depreciation rate using fixed rates including the basic rate adjusting rate and bonus rate.

This is the remaining. Yearly Depreciation Value 2 x straight-line depreciation rate x book value at the. In such cases depreciation is arrived at through the following formula.

In fact the cost of your new car drops as soon as you drive it off the dealership lot. 2020 Mercedes-Benz GLB launched in Malaysia. Flat depreciation calculator.

USB ports to keep. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value. Flat depreciation calculator by street photographer street photo - Add Photo.

How To Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Flat Rate Depreciation Recurrence Example Youtube

Depreciation Depreciation Is Concerned With The Value Of An Item Of Equipment After It Has Been In Use For Some Time People In Business Need To Calculate Ppt Download

Flat Interest Rate Double Entry Bookkeeping

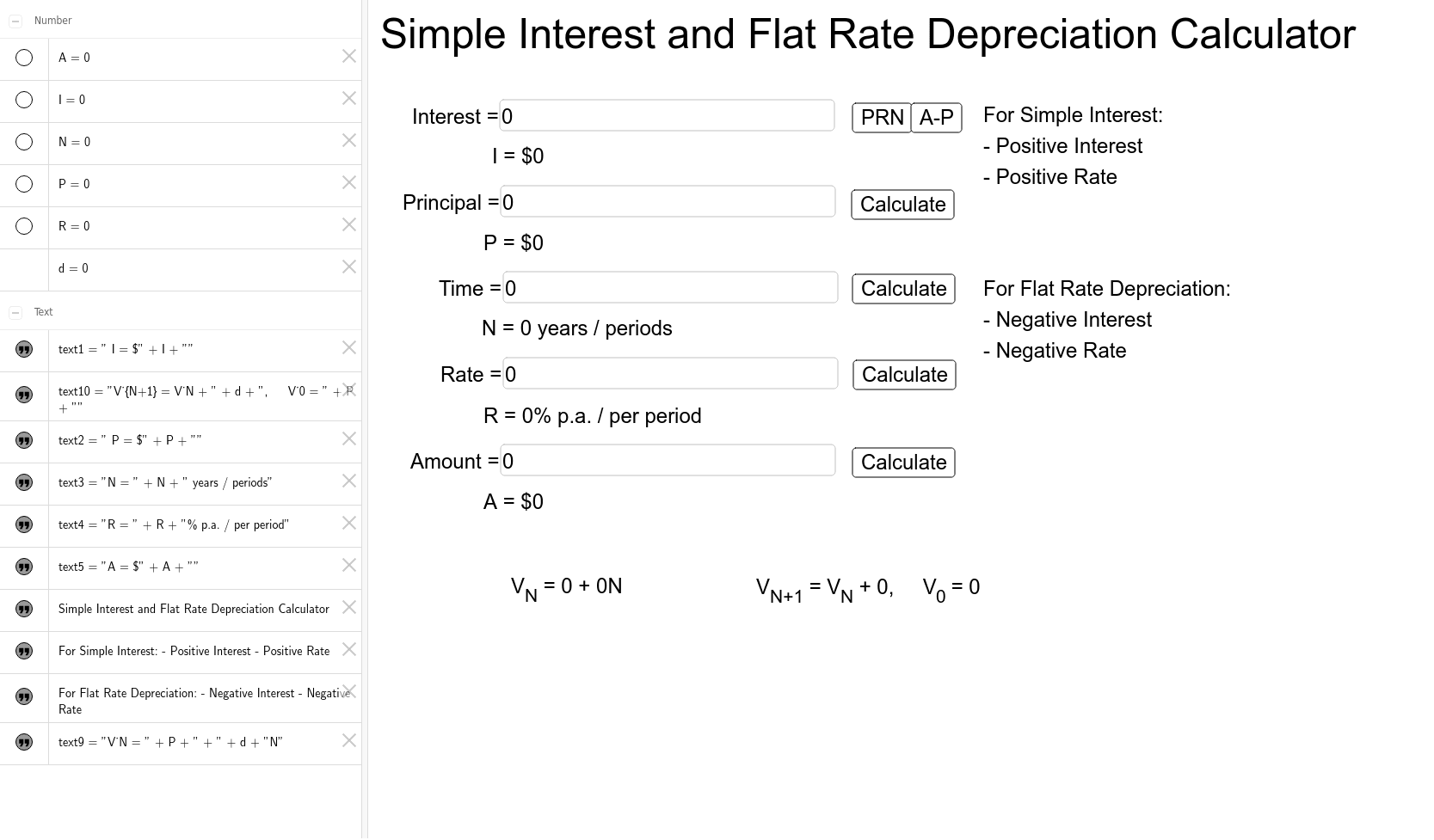

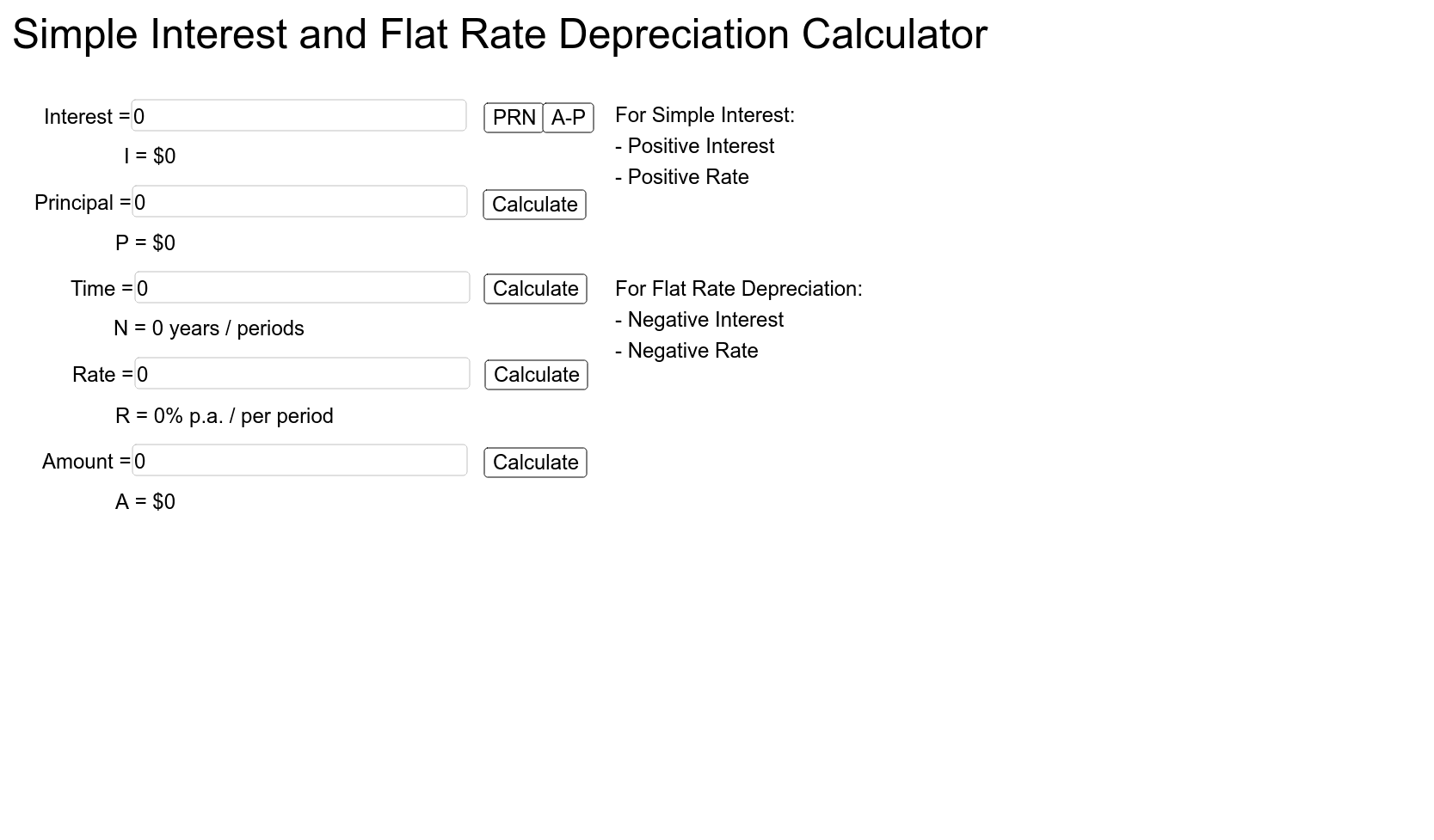

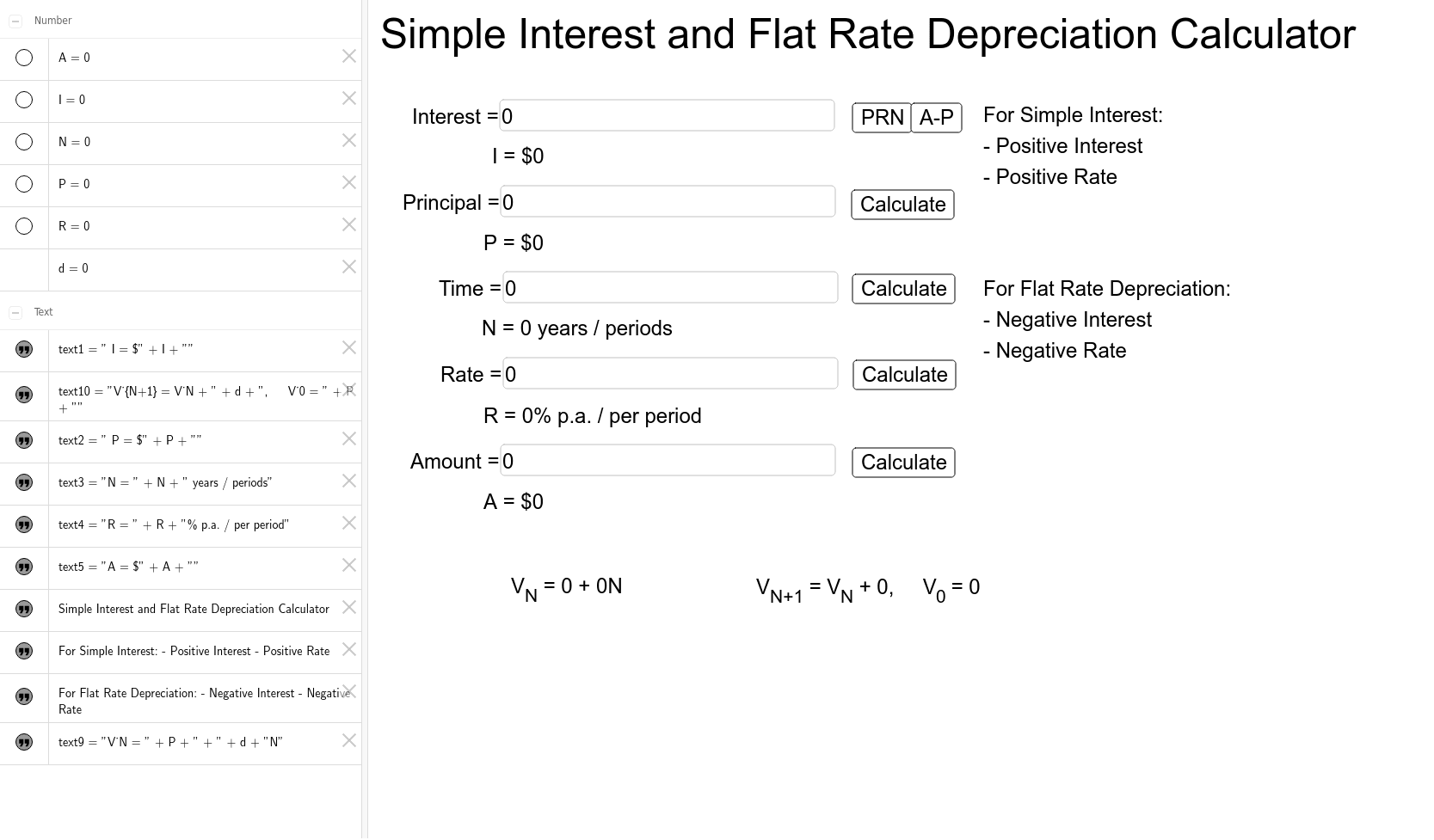

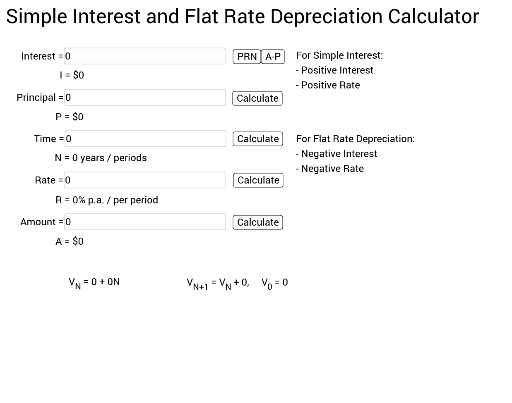

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Simple Interest And Flat Rate Depreciation Calculator Vce Geogebra

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

Depreciation Calculation For Flat Rate Methods Oracle Assets Help

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

2

Depreciation Rate Formula Examples How To Calculate

Flat Rate Depreciation General Formula Example Youtube

Simple Interest And Flat Rate Depreciation Calculator Vce Geogebra

Depreciation Calculation For Flat Rate Methods Oracle Assets Help

Straight Line Depreciation Calculator And Definition Retipster

Depreciation Depreciation Is Concerned With The Value Of An Item Of Equipment After It Has Been In Use For Some Time People In Business Need To Calculate Ppt Download